Middle Eastern involvement in M&A records lowest Q1 total since 2004

According to Thomson Reuters' quarterly investment banking analysis for the Middle East region, investment banking fees reached USD120.3 (QAR438 million) million during the first quarter of 2014, down 17 percent from the previous quarter.

The value of announced M&A transactions with any Middle Eastern involvement was 15 percent less than the USD6.8 billion witnessed during the same period last year, and marking the lowest first quarter total in the region since 2004. The low first quarter total was largely impacted by an 85 percent decline in domestic and inter-Middle Eastern M&A.

Nadim Najjar, managing director, Middle East, Africa, and Russia CIS pointed out that Middle Eastern investment banking fees were down 17 percent from the previous quarter and a two percent decline compared to the first quarter of 2013.

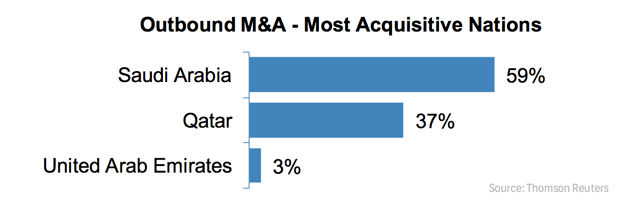

Mr. Najjar added that “Outbound M&A drove activity, up 147 percent from this time last year to total USD3.5 billion. Saudi Arabian overseas acquisitions accounted for 59 percent of Middle Eastern outbound M&A activity. Inbound M&A also increased, climbing 171 percent to USD506 million. The largest deal during the first quarter was Aramco’s purchase of a USD2 billion stake in South Korea’s petroleum and refinery company, S-Oil Corp. Boosted by this deal, Energy & Power was the most targeted sector, accounting for over half of first quarter activity. Morgan Stanley topped the 1Q 2014 announced any Middle Eastern involvement M&A league table with USD740 million.”

He added that “Equity Captital Markets (ECM) underwriting fees totalled USD39.6 million, more than twice the amount registered during the first quarter of 2013 (USD17.4 million) and marking the best annual start for ECM fees in the Middle East since 2008. ECM fees account for 33 percent of the fee pool, the highest first quarter share since 2006.”

However, he also pointed out that, Middle Eastern companies had raised only USD1 billion from two initial public offerings during the first quarter of 2014, a 37 percent decline in IPO activity from the same period in 2013 (USD1.6 billion). “There were no follow-on or convertible offerings in the region during the first quarter so overall,” he explained, “ECM activity fell 46 percent. The larger of the two IPOs was the USD905 million (QAR3.29 billion) offering from Mesaieed Petrochemical Holding, a unit of state-owned Qatar Petroleum. It was Qatar’s first IPO since 2010, and as sole bookrunner on the Mesaieed Petrochemical Holdings IPO, Qatar National Bank took first place in the 1Q 2014 Middle Eastern ECM ranking.”

Like this story? Share it.